Exness Deposit Options: A Comprehensive Guide

When it comes to trading in the financial markets, the process of depositing funds into your trading account is a critical first step. Exness, a prominent forex trading platform, offers a variety of Exness Deposit Options Exness deposit and withdrawals options designed to cater to the diverse needs of its users. In this article, we will explore the different methods available for depositing funds into your Exness account, their advantages and disadvantages, as well as tips to ensure a smooth transaction experience.

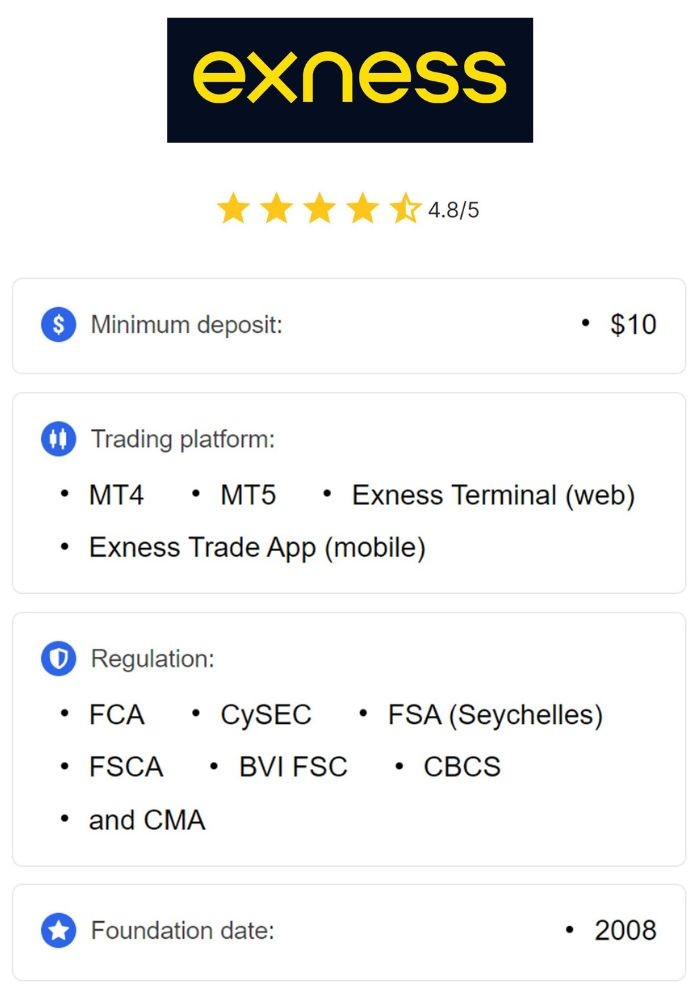

1. Overview of Exness

Exness is an international brokerage company founded in 2008. It is known for providing a wide range of trading instruments, from forex and commodities to cryptocurrencies and stocks. With its commitment to client satisfaction, Exness has established a reputation for reliability and transparency, making it an attractive option for traders worldwide. The platform caters to both novice and experienced traders, offering various account types and deposit options to support different trading strategies.

2. Choosing the Right Deposit Method

When choosing a deposit method on Exness, it is essential to consider factors such as transaction speed, fees, and convenience. Depending on your location and personal preferences, here are some of the most popular deposit options available:

2.1. Credit and Debit Cards

One of the most commonly used deposit methods is credit and debit cards. Exness accepts major cards such as Visa and Mastercard. The advantages of using cards include:

- Instant Deposits: Funds are typically available in your trading account almost immediately after the transaction is processed.

- Convenience: Most traders are familiar with card transactions, making this method easy to use.

- Secure Transactions: Banking regulations ensure a high level of security for card payments.

However, it is essential to note that some issuers may impose fees on transactions related to online trading; thus, checking with your bank is advisable.

2.2. E-Wallets

E-wallets have become increasingly popular among traders due to their ease of use and quick processing times. Exness supports various e-wallets, including:

- Skrill: A popular choice for online transactions, Skrill offers a user-friendly interface and instant transfers.

- Neteller: Known for secure transactions, Neteller also provides instant funding options for Exness accounts.

- Perfect Money: This e-wallet is favored for its low transaction fees and anonymity.

Using e-wallets can enhance your trading experience thanks to their speed and efficiency, although it is essential to ensure that your e-wallet provider supports operations in your country.

2.3. Bank Transfers

For traders who prefer traditional banking methods, bank transfers are a viable option. However, this method usually takes longer than other options, averaging between 1-5 business days. Here are some pros and cons:

- Pros: They are typically reliable and secure.

- Cons: Slower processing times and potential fees associated with international transfers, depending on your bank’s policies.

2.4. Cryptocurrency Deposits

With the increasing popularity of cryptocurrencies, Exness has embraced this trend by allowing deposits in various digital currencies. Bitcoin, Ethereum, and other cryptocurrencies can be deposited, providing traders with an alternative payment method.

Advantages of using cryptocurrencies include:

- Fast Transactions: Crypto transfers are typically completed within minutes.

- Lower Fees: Transaction fees can be lower compared to traditional banking methods.

- Anonymity: Cryptocurrency transactions offer a higher level of privacy compared to other deposit methods.

However, the key disadvantage lies in the volatility of cryptocurrencies, which can affect the value of funds deposited.

3. How to Deposit Funds at Exness

Depositing funds at Exness is a straightforward process. Here are the steps to follow:

- Create an Account: If you haven’t already, sign up for an Exness trading account.

- Log In: Use your credentials to log in to your Exness personal area.

- Select “Deposit”: From the menu, select the “Deposit” option.

- Choose Your Method: Pick your preferred deposit method from the options available.

- Enter Deposit Amount: Specify how much you wish to deposit.

- Complete Transaction: Follow the instructions provided to finalize your deposit.

Once your transaction is complete, you should see the funds in your trading account shortly, depending on the deposit method chosen.

4. Important Considerations

Before making a deposit, consider the following:

- Minimum Deposit Requirements: Exness has minimum deposit amounts for different account types, so be sure to check what applies to your account.

- Fees: While many deposit methods are free, some might attract fees, particularly during withdrawals, so it is wise to familiarize yourself with any charges associated with your chosen method.

- Verification: Be aware that some deposit methods may require additional verification, especially if you are using a bank account or e-wallet for the first time. It’s essential to complete all necessary documentation to avoid delays.

5. Final Thoughts

In conclusion, Exness offers a variety of deposit options tailored to meet the needs of traders across the globe. Each method comes with its benefits and drawbacks, making it crucial to choose one that aligns with your trading style and financial preferences. By understanding the different Exness deposit options, you can ensure a seamless and efficient funding process, allowing you to focus on what truly matters—your trading strategies and market performance.