When a falling wedge is seen in a downtrend, then it is indicative of a reversal pattern in the asset’s value. When a falling wedge is found in an uptrend, meanwhile, it is indicative of a continuation of the https://g-markets.net/ trend. To look for a continuation of a move, traders will find patterns like triangles, rectangles, pennants and flags. Each one of these patterns can be identified on charts of the timeframe of your choice.

Some may spot a perfect breakout opportunity on the horizon, while others only see a previous resistance alternating time frames. Understanding continuation pattern ins and outs and a trading plan built upon pattern features may serve in your favor when trading. Here’s a quick list of steps you can pay attention to when being strategic about your continuation pattern trading [If you believe a pennant pattern is forming]. The continuation part doesn’t necessarily mean the pattern is reliable, though.

Trade With the Right Knowledge

Welcome to the dynamic world of Artificial Intelligence (AI) penny stocks. With the right mindset and an eye for patterns, you can spot safer ways to take trades. Compare that to the volume with the first signal — where it breaks out of the gun pattern. Notice the low volume where it breaks resistance on the triangle.

The descending triangle is basically a mirror image of the ascending triangle. In this case, the upper trend line has a downward slope while the lower line is just horizontal. This occurs because the sellers are more aggressive than buyers. Therefore, it is a bearish continuation pattern which is completed when prices breakout to the downside.

Working With Continuation Patterns

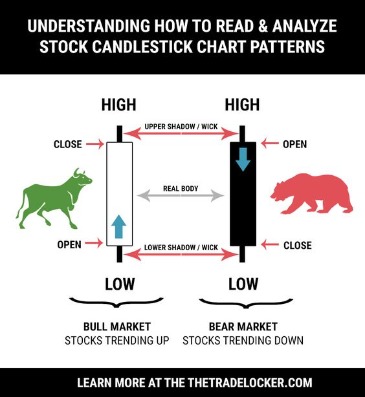

The longer the candles in the bullish “Separating lines” pattern are, the more reliable this pattern is. However, it’s always safer to wait for confirmation in the form of another bullish candlestick after the pattern. Ascending triangles, are formed when consistent highs and higher lows are made. The ascending triangle is generally a bullish signal with price tending to break out upwards when the pattern is complete. Volume plays a role in these patterns, often declining during the pattern’s formation and increasing as price breaks out of the pattern.

In a bearish mat hold formation, the first downward candle is followed by a gap down and then three small candles that move higher but below the high of the first. The fifth bar has a large body and closes lower than the first. The Downside Tasuki Gap indicates the momentum behind a downward trend. The strength of the trend is indicated by the price gapping lower and a new red candle forming. This move is followed by a pause as buyers attempt to push the price higher. However, the price does not fill the gap, and the selloff is resumed.

Analyzing Binance Coin Support and Resistance Zones for Trading … – BTC Peers

Analyzing Binance Coin Support and Resistance Zones for Trading ….

Posted: Sat, 09 Sep 2023 19:10:21 GMT [source]

By the way, the chart setup I am presenting here is a sneak peek of my good old Futures strategy adopted to Forex and other markets. Nothing has changed, we are still trading pullbacks within the trend, we merely switched from tickcharts to timecharts and stayed true to our principles. Expect more to come soon, I am stoked to bring this to all of you!

Ascending triangle

While a price pattern is forming, there is no way to tell if the trend will continue or reverse. As such, careful attention must be placed on the trendlines used to draw the price pattern and whether the price breaks above or below the continuation zone. Technical analysts typically recommend assuming a trend will continue until it is confirmed that it has reversed. Take Profit may be set at 60-80% of the flag pennant pattern height, i.e. the range of the previous price movement. Depending on your trading strategy, Stop Loss can be set in the middle of the channel, which would reduce the potential losses in case the price moves against your expectations.

- Each one of these patterns can be identified on charts of the timeframe of your choice.

- Then, after the period of consolidation, the trend continues in its original direction.

- But if you draw a horizontal line across the top and across the bottom, you’ll see it.

- They had a flat resistance level on top and a curved support level on the bottom.

- During the consolidation period, the trained trader can spot common patterns on the chart.

- The descending triangle is the opposite of the ascending triangle, indicating that demand is decreasing, and a descending upper trend line suggests a breakdown is likely to occur.

A bearish gapping play has one long bearish candle, several small candles, and a large downward candlestick opening with a gap down. The structure follows a pause in the trend indicated by the small candles occurring after a series of large downward candles. The small bars before the gap must be in the lower area of the previous large falling candle. Once you’ve got it down to where you’re winning more than half the time, you can give live trading a shot. It’s how you can practice identifying continuation patterns and so much more. Some of those initial consolidation periods were wedge-shaped.

Trend Continuation Patterns: Key Takeaways

Traders use patterns to limit the exposure of the market and find more accurate etnry/exit points. As such, patterns may either increase profits, limit risks, or make your trading more efficient by reducing the time spent on research. The triangle pattern is also referred to as a trading triangle. You can see what the descending triangle looks like in the picture above. We describe all the pattern in detail later on, meanwhile, just get familiar with a visual look for the overall understanding. When trading a continuation, consider the strength of the price move prior to the pattern forming.

The chartist will look for an increase in the trading volume as the key indication that new highs will form. An ascending triangle pattern will take about four weeks or so to form and will not likely last more than 90 days. Descending triangles are the opposite of ascending triangles. They are formed with consistent lows and lower highs. This is generally a bearish signal and price will tend to break out lower when the pattern is complete.

Wedge Chart Pattern: Forex Chart Pattern

The longer the price is in the range, the higher the probability of breaking through the boundary. However, if the formation of a symmetrical triangle was preceded by an uptrend, this pattern would signal a high probability of continued bull dominance. On the other hand, the formation of a symmetrical triangle may result in a trend reversal. Hence, the confirmation of the continuation of the trend or its reversal is the direction of penetration of the sides of the triangle.

That is why they are often called the “servants of two masters” where the price can exit in any direction. Typically, flag patterns are related to price movements that result from the news. The price will drop or rise dramatically after a strong trend and then be followed by continuation. The descending triangle is the opposite of the ascending triangle, indicating that demand is decreasing, and a descending upper trend line suggests a breakdown is likely to occur. It’s usually not that easy to recognize the end of a correction.

It might look that way on a daily chart … But in fact, those big moves are the result of hours of price action. During this period of indecision, the highs and the lows seem to come together at the point of the triangle with virtually no significant volume. Markets never move in one direction forever, so technical analysts are looking for indications that the market trend is changing, by either reversing or continuing a move. Technical analysts look for certain types of patterns that generally indicate that a market will reverse or continue moving in a certain direction. Depending on who you talk to, there are more than 35 patterns used by traders.

The appearance of such a combination of candles doesn’t mean that it’s necessary to enter the trade. For example, a trader enters the market when a reversal pattern is formed, which gives rise to this trend. A trader usually waits for the developments and faces the corrections, which end up as trend continuation patterns. Consequently, a trader doesn’t exit the initial trade and further waits, the final profit will increase as the price climbs higher. Often a bullish chart pattern, the ascending triangle pattern in an uptrend is not only easy to recognize but is also a slam-dunk as an entry or exit signal. It should be noted that a recognized trend should be in place for the triangle to be considered a continuation pattern.

More often than not we do not get a symmetrical channel, which would be classified as a flag, but rather an expanding or condensing channel, like in this case. They can all be classified into channels trend continuation patterns – expanding, condensing, symmetrical, their angle either against the trend or with the trend. Inside those channels, we get different opportunities to re-enter in the direction of the trend.

The third denotes a pause in the trend as sellers attempt to move the price lower but fail to close the gap, which suggests that the rally is likely to continue. Learning to recognize continuation patterns is crucial to your trading foundation. Take the four patterns we talked about today and go find some examples. They don’t have to be perfect, but you need to be able to see them pretty clearly. Another thing you might notice with this pattern … The price action on the breakout or breakdown after the flag is similar in range to the movement before the flag. Flags are pretty easy to see — the initial price movement, aka flagpole, is steep.